On the heels of the Brexit and continued economic recession in many countries around the globe, international investors are increasingly looking towards the relative safe haven of the United States. I am personally feeling the impact of increased Foreign Direct Investment in the United States (FDIUS) in my business, as there is a clear uptick in number of international buyers interested in acquiring U.S based companies.

I’ve recently completed one such transaction with a buyer originally from the UK, utilizing the fantastic E-2 Visa process. This transaction was a true win-win, in which the sellers were paid in cash for their business, and the buyer purchased a very strong business, and was granted an E-2 visa to boot.

What is an E-2 Visa?

The E-2 is a category of visa for certain residents of countries which the U.S has a treaty with, that allows an individual to enter and work inside of the United States based on an investment he or she will be controlling, while inside the United States. This visa must generally be renewed every two years, but there is no limit to how many times one can renew. The investment must be “substantial.” Upon conclusion of the business, investors must return to their countries of origin, or change their status. The holder of an E-2 visa may leave the United States at any time.

As I learned first hand, there are many benefits to the Seller of utilizing the E-2 visa, including:

- Motivated and Responsive Buyer – Buyers will be especially motivated as the visa is on the line and will therefore be more likely to be responsive and prioritize this transaction over other deals

- Attractive Deal Terms – Buyer must deposit the full purchase price into escrow before applying for the visa, so sellers will generally receive all cash at closing

- Less Negotiating on Non Critical Deal Points – As the buyer has a dual objective of getting the visa and owning the business, the buyer will be more likely to focus more on the big picture (visa) and less on the types of less significant deal points that can typically drag deals out.

- Higher probability of close – For the above reasons, this type of transaction has a very high likelihood of closing if the buyer’s E-2 application is successful.

Similarly, there are substantial benefits to Buyers, which include:

- U.S. Visa granted if application is successful

- Buyers must submit a business plan to the U.S. Consulate, which forces buyers to think deeply about the business, making them more prepared to take over and manage the business once the deal has been completed

Before jumping into this process, Buyers and Sellers should be made aware of the many dependencies that can make this a time-consuming process. The buyer must complete all of the items below before submitting the E-2 application:

- Hire an immigration attorney with experience in E-2 visa processing. The Immigration Attorney will review the business financials, the applicant’s background and personal motivation, and make an assessment of the probability of having the visa granted. For UK nationals seeking immigration to the U.S. I would highly recommend Kehrela Hodkinson, who masterfully managed this process. I would also recommend Jennifer Grady, Esq. who has successfully supported E-2 applicants from North America and several European, Latin American and Asian countries.

- Create a U.S. legal entity (LLC, S-Corp etc.) and formal operating agreement with at least two owners and receive a Federal Tax ID number.

- Complete a formal business plan, which identifies specific growth plans, expected hiring, marketing opportunities, etc. If comprehensive, the Confidential Business Review (CBR/CIM) should provide 70-80% of what is required for the business plan.

- Sign binding Purchase Agreement and Escrow Instructions. A signed Letter of Intent will not be sufficient.

- Wire funds to complete purchase, lease deposits and other pro-rations into escrow

- Complete Lease Assignment or new lease with landlord- this one can be tricky as the landlord may ask for a personal guarantee or a significant down payment.

Once all of the above have been completed, the visa application can be formally submitted to the U.S. Consulate. From this point, there is generally a 4-6 week wait for processing time before the buyer will be called to the U.S. Embassy for an interview. Assuming the interview is successful, the buyer’s visa will be processed within two weeks and then escrow can close.

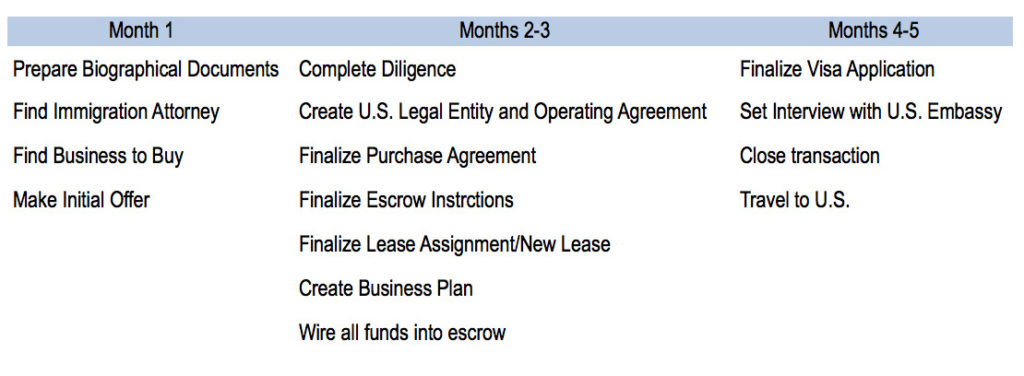

Approximate Timeline

While there are many benefits for buyers and sellers in utilizing the E-2 visa process for M&A transactions, an accelerated transaction timeline is not one of them! Based on experience, you should expect this process to take 3-4 months from the time the initial offer is accepted, assuming everything goes relatively smoothly along the way. The following lays out the approximate timeline to complete the transaction.

Lessons Learned

While this was an extremely positive experience that resulted in a win/win for buyer and seller, I learned the following, which will help make the process more efficient on my next E-2 deal:

- Strongly suggest the buyer utilize a reputable, local corporate attorney – As buyer was based in UK, he did not have a responsive U.S-based corporate attorney to support corporation set-up, lease review etc. and as a result, we lost a couple weeks due to unresponsiveness of the attorney.

- Get to the landlord as early as possible as soon as the purchase agreement is signed– this goes for all transactions, not just E-2 deals, but we lost time dealing with time zone issues as well as reconciling inconsistent personal financial statement formats.

In summary, I would highly recommend an E-2 process for deals where Sellers prioritize all or mostly cash deals and are not in a tremendous hurry to sell their business.

Kevin Berson is licensed Business Broker with Kinected Consulting and is based in Los Angeles, CA. He specializes in helping business owners of lower middle-market companies ($1M-20M transaction value) maximize outcomes in selling their businesses. He is also the founder of Kinected, a management consulting firm that advises companies with business development, strategy and merger and acquisition diligence. Kevin can be reached at kevin@kinected.com.